About Us

Mission

The Collegium educates and forms students, through the traditions of the Church,

to restore all things in Christ.

Our mission is built on four pillars: the traditional Latin Mass and Divine Office, a traditional Catholic curriculum, a unique student work program, and a close-knit community.

Traditional Latin Mass and Divine Office

We embrace the liturgical traditions of the Church because they most fully express the goodness, truth, and beauty of the faith.

Currently the traditional Latin Mass (TLM) is offered at nearby St. Mary’s Catholic Church, as is the novus ordo Missae, which our students are also welcome to attend. We also sing Lauds and Vespers in the traditional Benedictine manner each weekday.

However, our program is more than just a series of courses, liturgies, and student jobs. Spiritual formation is integrated into the experience:

- prayer (Lauds, Mass, Vespers, Angelus, grace before and after meals) is integrated into the daily routine;

- meals are taken as a community;

- work is required of every student, partially for its spiritual benefits and partially to help offset costs.

In addition, confession, adoration, and spiritual direction are all available with our parish pastor or at the parish two blocks from campus, where there is also an adoration chapel.

Our liturgical life underpins several qualities of Benedictine Spirituality that are infused into our program:

- Liturgy (Office and Mass),

- Obedience and Humility,

- Personal Conversion,

- Hospitality and Community,

- Dignity of Work (ora et labora),

- Simplicity of Life and Stewardship.

Traditional Catholic Curriculum

Our curriculum is unlike any other college curriculum. It is based on a centuries-old model of liberal education: an overarching study of the human experience, including humanity’s history, the physical world in which we live, and the natural laws of reality that bind us. The paradigm of Aristotelian Realism permeates and integrates the entirety of our curriculum. This reaches even into our math and science courses, uniting them to the study of philosophy and theology and leading the student to see how all our knowledge is united in the knowledge and love of God.

We teach a curriculum that is as much a process as it is a list of courses.

Students start with the processes of learning: grammar, logic, rhetoric.

They apply these processes to the natural and physical sciences – those things that we can see, hear, and touch.

Finally, they apply these processes to philosophy and theology – those things that we cannot see and touch but that are just as real.

We embrace the traditional Catholic faith, the unchanging teachings and practices that have both shaped the faith of all the saints we venerate and shone as a beacon of light – the light of the Truth – to a world lost in darkness.

We teach theology based on the writings of St. Thomas Aquinas, the greatest theologian in the history of the Church.

We teach mathematics as incorporated within our inquiry into creation as the science of quantifiable being. This roots mathematics in the real world and provides a sure foundation for its applications.

We teach the natural sciences with the Aristotelian-Thomistic framework of inquiring into the causes and principles of the created world. In this way, science proceeds by mixing mathematics with our observations of the physical world, but without leaving behind its philosophical foundations.

Unique Student Work Program

Liberal arts students acquire a wide range of skills that are applicable to most fields of employment, for example, the abilities to think clearly and logically, to express oneself concisely, to problem solve, and the ability and desire to learn. At the same time, we help students gain work experience and various employment skills without having a myriad of “majors.” Every Collegium student participates in a work program, called Ora et labora, in which he gains experience and skills in different fields.

We also enhance these skills in several ways:

- we coach students to recognize these skills and to articulate them in resumes and job interviews;

- we provide opportunities for students to get additional courses for fields that require them, such as science courses at the nearby community college to prepare for the MCATs;

- we keep a publication of

- positions and graduate programs for which no additional course work is necessary;

- positions for which we can provide work experiences;

- positions and graduate programs for which additional courses or training may be required and how students can attain these courses or training.

Close-knit Community

Collegium students live together, study together, work, eat, and play together. We are a small tight-knit community, in which students forge friendships that will last throughout their lives.

Restoring All Things in Christ

Collegium students are not “conformed to this world but transformed by the renewal of their minds” (Rom. 12:2) hearts, and souls. They are equipped not just to “discern what is the will of God, what is good and acceptable and perfect,” (Rom. 12:2) but also to be ambassadors of the good, the acceptable, and the perfect in society. Formed then with a perspective on eternity but equipped to live in the here and now, Collegium students are truly in mundo sed non mundi and able to transform the culture into one in which Jesus Christ reigns as ‘King of kings and Lord of lords’ (Rev. 19:16) and Who will satisfy the deepest needs and longings of his people (see Isa. 40:9,10).

The Collegium has developed a model, rethinking higher education from the ground up with a view toward long-term sustainability.

- Lower tuition up front

- Supporting revenue from auxiliary enterprise(s)

- Students participate in these as part of a Benedictine model of ora et labora

- Keeping facility and faculty needs limited:

- Small student body (maximum of 120)

- Singular liberal arts focus.

- Faculty and staff hired within a framework of sacrificial work. Administrative overhead kept to a minimum; all administrators also teach. Salaries will be adequate; housing may be part of compensation.

- Gifts from benefactors committed to the mission and vision of The Collegium.

Collegium Sanctorum Angelorum is an independent institution of higher learning. We have no legal affiliation or legal relationship with the Roman Catholic Church.

We do, however, have a cordial relationship with the archdiocese, which has assured the local foundation providing significant support to The Collegium, that the archdiocese has no objection to our opening.

We do also pledge full and unswerving fidelity to the unchanging magisterium of the Catholic Church, and we recognize both the authority and the responsibility of the local Ordinary to assure that anything taught in his diocese that relates to the Catholic faith is taught in accord with the magisterial teaching of the Catholic Church.

Out of respect for this authority and responsibility, the Collegium submits the syllabus of each of its courses to the local Ordinary, so that he can be assured that everything taught at the Collegium is in accord with the magisterial teaching of the Catholic Church.

The four marks of the Collegium describe the unique culture of the Collegium. They will give you an idea of what it is like to be a Collegian.

- Deum Nóscere Deum Amáre. (To Know God Is to Love God.)

We are first and foremost an academic institution. Students are engaged in a classical liberal arts curriculum that emphasizes Thomistic theology and philosophy, history, literature, Latin, math, science, music, and art all of which is directed toward the knowledge of the Truth, which is God.

- Cantáte Dómino. (Sing to the Lord.)

Vespers and Lauds will be sung daily. Faculty will be committed to this practice; students will be welcomed to assist. The Holy Sacrifice of the Mass is offered on Sundays, Mondays, Holy Days, and major feasts and most weekdays. Confessions are available at least weekly. The Masses are normally sung Masses. Students with musical skills will be given opportunities to advance those skills and use them in the service of the Lord.

Where on Earth Did Chant Come From?

- In Mundo Sed Non de Mundo. (In the World but Not of the World.)

The Collegium is a downtown campus. As such, we have a unique opportunity to engage the community. Students work at different downtown businesses, where employers are able to see the faith as lived by Collegium students. At the same time, The Collegium’s program of education and formation is a constant reminder to students that this world is not our true home. That is heaven. Thus, students have opportunities to spend time quietly, particularly in the adoration chapel, anchoring themselves spiritually to better engage the world.

- Ora et Labóra. (Prayer and Work.)

Students work in the Collegium’s Corporate Internship Program, thereby gaining the spiritual benefits of work, the practical benefits of work experience, the ability to understand the connection between a liberal arts education and success in the professional world. Students also make valuable additions to their resumés.

Introduction

The Oath Against Modernism was instituted on 1 September 1910 by Pope Pius X in his motu proprio “Sacrorum antistitum.” It was required of “all clergy, pastors, confessors, preachers, religious superiors, and professors in philosophical-theological seminaries” of the Catholic Church from 1910 until 17 July 1967, when it was rescinded by the Congregation for the Doctrine of the Faith with the approval of Pope Paul VI. At the Collegium, it is critical that every person who works for the institution, every person who attends the institution, and every parent who is sending a student to the institution is fully committed to the institution’s mission. The Oath Against Modernism is, to our knowledge, the clearest expression of the essential, unchanging tenets of the Catholic faith and the strongest form of commitment to these tenets, which are perennially taught by the Catholic Church, and which are at the heart of our mission. Thus, we ask every faculty member, staff member, student, and parent/guardian of a student to sign this oath in order to work at, attend, or have a child attend The Collegium.

The Oath

I . . . . firmly embrace and accept each and every definition that has been set forth and declared by the unerring teaching authority of the Church, especially those principal truths which are directly opposed to the errors of this day. And first of all, I profess that God, the origin and end of all things, can be known with certainty by the natural light of reason from the created world (see Rom. 1:19), that is, from the visible works of creation, as a cause from its effects, and that, therefore, his existence can also be demonstrated: Secondly, I accept and acknowledge the external proofs of revelation, that is, divine acts and especially miracles and prophecies as the surest signs of the divine origin of the Christian religion and I hold that these same proofs are well adapted to the understanding of all eras and all men, even of this time. Thirdly, I believe with equally firm faith that the Church, the guardian and teacher of the revealed word, was personally instituted by the real and historical Christ when he lived among us, and that the Church was built upon Peter, the prince of the apostolic hierarchy, and his successors for the duration of time. Fourthly, I sincerely hold that the doctrine of faith was handed down to us from the apostles through the orthodox Fathers in exactly the same meaning and always in the same purport. Therefore, I entirely reject the heretical’ misrepresentation that dogmas evolve and change from one meaning to another different from the one which the Church held previously. I also condemn every error according to which, in place of the divine deposit which has been given to the spouse of Christ to be carefully guarded by her, there is put a philosophical figment or product of a human conscience that has gradually been developed by human effort and will continue to develop indefinitely. Fifthly, I hold with certainty and sincerely confess that faith is not a blind sentiment of religion welling up from the depths of the subconscious under the impulse of the heart and the motion of a will trained to morality; but faith is a genuine assent of the intellect to truth received by hearing from an external source. By this assent, because of the authority of the supremely truthful God, we believe to be true that which has been revealed and attested to by a personal God, our creator and lord. Furthermore, with due reverence, I submit and adhere with my whole heart to the condemnations, declarations, and all the prescripts contained in the encyclical Pascendi and in the decree Lamentabili, especially those concerning what is known as the history of dogmas. I also reject the error of those who say that the faith held by the Church can contradict history, and that Catholic dogmas, in the sense in which they are now understood, are irreconcilable with a more realistic view of the origins of the Christian religion. I also condemn and reject the opinion of those who say that a well-educated Christian assumes a dual personality-that of a believer and at the same time of a historian, as if it were permissible for a historian to hold things that contradict the faith of the believer, or to establish premises which, provided there be no direct denial of dogmas, would lead to the conclusion that dogmas are either false or doubtful. Likewise, I reject that method of judging and interpreting Sacred Scripture which, departing from the tradition of the Church, the analogy of faith, and the norms of the Apostolic See, embraces the misrepresentations of the rationalists and with no prudence or restraint adopts textual criticism as the one and supreme norm. Furthermore, I reject the opinion of those who hold that a professor lecturing or writing on a historicotheological subject should first put aside any preconceived opinion about the supernatural origin of Catholic tradition or about the divine promise of help to preserve all revealed truth forever; and that they should then interpret the writings of each of the Fathers solely by scientific principles, excluding all sacred authority, and with the same liberty of judgment that is common in the investigation of all ordinary historical documents. Finally, I declare that I am completely opposed to the error of the modernists who hold that there is nothing divine in sacred tradition; or what is far worse, say that there is, but in a pantheistic sense, with the result that there would remain nothing but this plain simple fact-one to be put on a par with the ordinary facts of history-the fact, namely, that a group of men by their own labor, skill, and talent have continued through subsequent ages a school begun by Christ and his apostles. I firmly hold, then, and shall hold to my dying breath the belief of the Fathers in the charism of truth, which certainly is, was, and always will be in the succession of the episcopacy from the apostles. The purpose of this is, then, not that dogma may be tailored according to what seems better and more suited to the culture of each age; rather, that the absolute and immutable truth preached by the apostles from the beginning may never be believed to be different, may never be understood in any other way. I promise that I shall keep all these articles faithfully, entirely, and sincerely, and guard them inviolate, in no way deviating from them in teaching or in any way in word or in writing. Thus I promise, this I swear, so help me God. . .

The Collegium is listed in the Newman Guide to Catholic Colleges.

See the listing here.

Our listing is “provisional,” not because we do not meet standards.

Indeed, we rank in the Gold category in all the standards.

We are provisional until we graduate our first class, which will by in 2025.

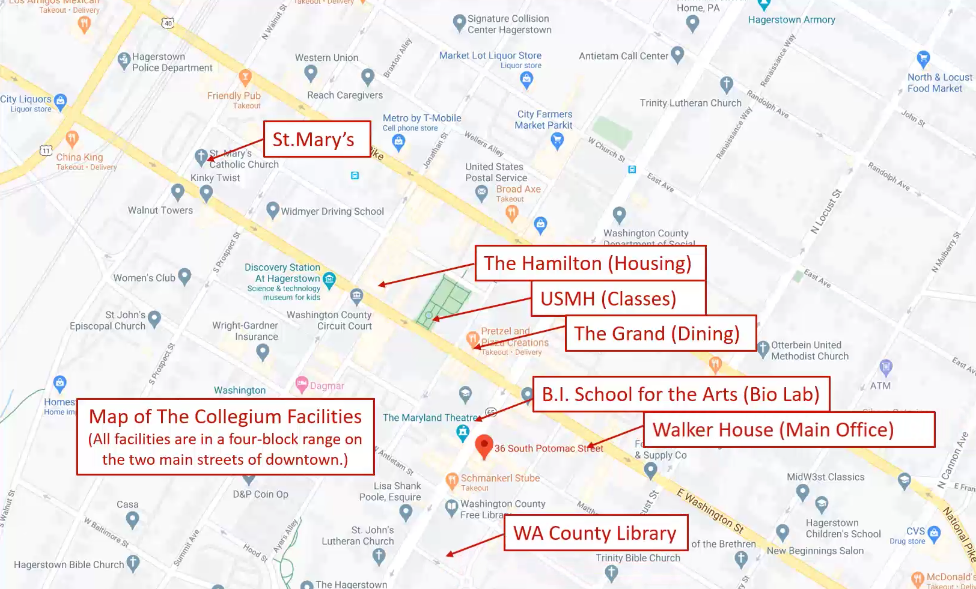

Campus

Hagerstown MD

The Collegium is located in downtown Hagerstown, MD. We are proud to be part of the revitalization of this historic town, adding our efforts to a recent renovation and expansion of the Maryland Theater, the opening of the Barbara Ingram School for the Arts, and the University of Maryland Hagerstown Campus.

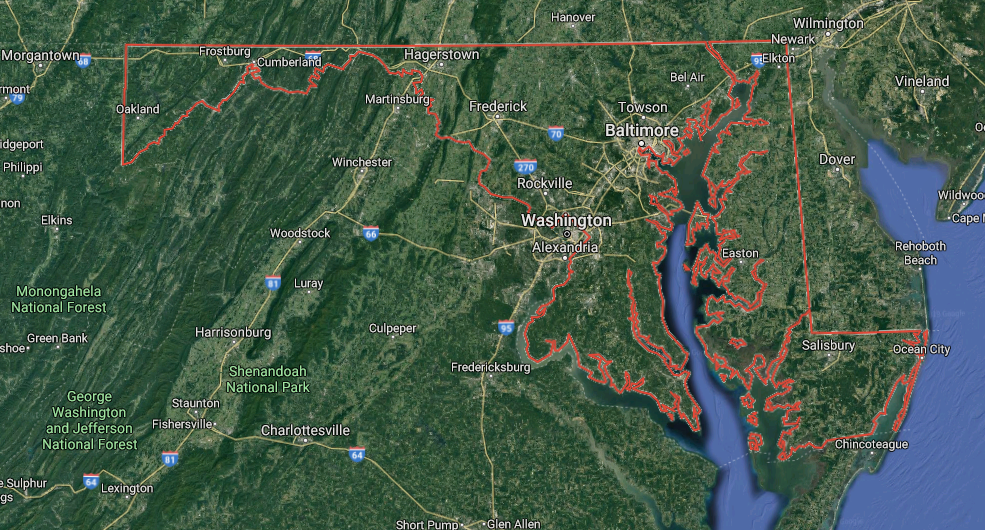

Hagerstown is in the “neck” of Maryland, in the foothills of Western Maryland. It is 75 miles from Baltimore and 75 miles from Washington DC, at the intersection of I-70 and I-81 – easily accessible from anywhere in the country and within a short drive to major historic sites and artistic events in Baltimore and Washington.

Hagerstown is located in Washinton County, which is home, or close, to five national parks:

- Antietam National Battlefield & Antietam National Cemetery;

- Chesapeake and Ohio Canal National Historic Park;

- Appalachian National Scenic Trail;

- Harper’s Ferry National Historic Park;

- Potomac Heritage National Scenic Trail.

Our Facilities

Student housing

Adoration and Confession at St. Mary's Catholic Church

Lauds on campus

Vespers on campus

Classes

Why the Liberal Arts Matter

Phillip Berns